Whether to hire a bookkeeper or not has undoubtedly come into your mind as a business owner. Bookkeepers help keep your financial records organized and accurate, freeing up your time and reducing the chance of mistakes.

Once deciding to hire, it’s essential to learn how to hire a bookkeeper the right way.

This article will explore why you need a bookkeeper, their duties and essential characteristics, online platforms where you can hire one, and tips for who to hire.

Why You Need a Bookkeeper

1. Organizing and Generating Accurate Records

A bookkeeper assists a business in keeping precise and organized records of financial transactions, such as sales, expenses, accounts payable, and more.

Having well-organized financial records allows you to take care of the financial health of your business, seeing where your income is coming from and where it’s being spent. With organized records, you can plan ahead for bill payments, fundraising, or staffing decisions.

However, maintaining organized records is just the beginning. A bookkeeper also helps produce accurate financial reports, such as balance sheets, profit and loss statements, and cash flow statements.

Every decision you make for your business will have a financial angle, and inaccurate financial records can lead to decisions that can potentially bankrupt your business.

2. Saves You Time and Energy

Hiring a bookkeeper will take a lot of responsibilities and work off your shoulders.

Bookkeeping isn’t everyone’s cup of tea, and if you’re not a numbers person, you’d have a hard time tracking business transactions.

In such cases, hiring a bookkeeper who can save you time, energy, and money is a wise decision.

3. Can Provide Crucial Insights

A bookkeeper can review your business finances, check for discrepancies (if any), and share insights that will help you make better business decisions. They can also streamline the bookkeeping process so that you don’t face any issues during the tax season.

Responsibilities of a Bookkeeper

- Records transactions: Records daily business transactions such as sales, inventory, expenses, etc.

- Maintains accurate records: Maintains accurate transactional records and generates your balance sheet, profit and loss statement, and cash flow statement monthly.

- Reconciles accounts: Reconciles bank account and credit card statements to ensure the accuracy of your books.

- Helps with taxes: Educates you about sales and other kinds of taxes involved in your business, and works in tandem with you and your tax accountant during tax season.

- Tracks performance: Assists in budget preparation, tracks business’s performance against the budget, and comes up with ideas to cut business expenses wherever possible.

Qualities to Look for In a Bookkeeper

1. Detail-Oriented and Organized

A small mistake in a decimal point or miscounting zeros could have severe consequences for your business. It is crucial to find a bookkeeper who is detail-oriented, focused, organized, and able to correct any errors they may detect quickly.

Pro Tip: Look for a bookkeeper who is familiar with working with your type of business so that they can detect patterns in the financial records and prevent mistakes.

2. Proficient in Using Accounting Software

Accounting software helps bookkeepers make all financial processes efficient by eliminating errors and automating repetition.

By utilizing accounting software, a bookkeeper can streamline the process of generating financial statements and eliminate the need for manual data entry in spreadsheets.

So find a bookkeeper willing to integrate accounting software into their bookkeeping process.

3. Trustworthy

Anyone you hire for your business must be trustworthy. But when it comes to dealing with business finances, trust is an essential quality to look for in a bookkeeper. That’s because your bookkeeper will handle crucial and delicate information that will stay between you, your business, and the bookkeeper you hire.

Places to Look to Hire a Bookkeeper

1. Recommendations

One of the easiest and most reliable ways to hire a bookkeeper is to ask around in your network.

If you’re active on Linkedin, publish a post asking if there are any bookkeepers in your network and start talking to them.

You can also ask your network to recommend a bookkeeper they might’ve used at some point. If they’ve worked with or know of a good bookkeeper, they’ll likely be willing to pass along that person’s contact information.

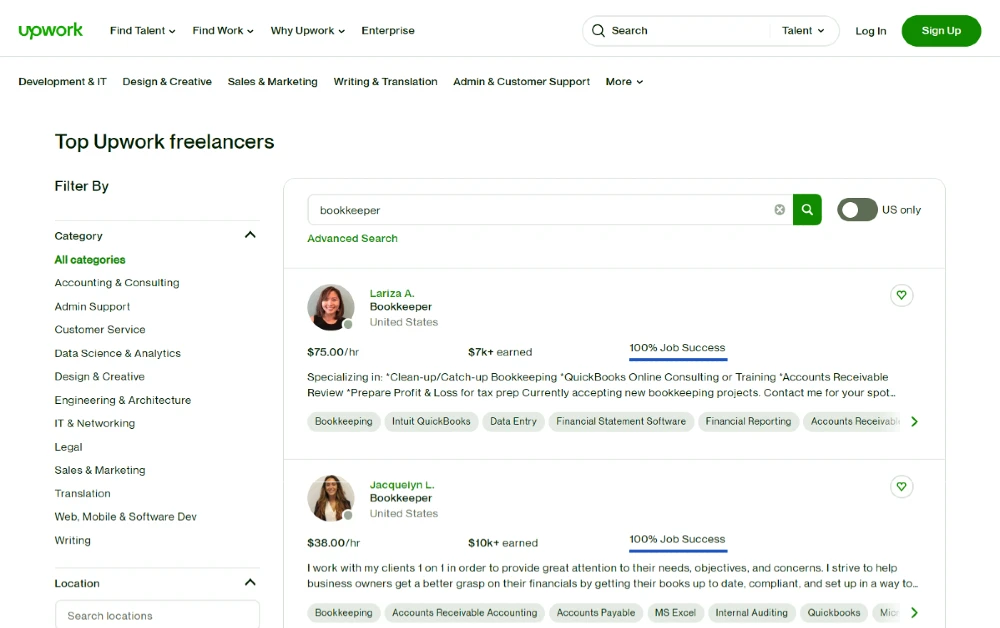

2. Upwork

Upwork is one of the most popular freelance hiring platforms. It’s trusted by the likes of Microsoft, Airbnb, Bissell, and many more.

There are two ways to hire a bookkeeper from Upwork:

- You can either post a job on the platform and wait for candidates to fill out the application

- Or you can search for bookkeepers, review their profiles, and send offers to them

The bookkeepers on Upwork charge hourly rates and the hiring costs range from $10 to $125 per hour.

3. QuickBooks Bookkeeper

Quickbooks offers its own certified bookkeepers who will update, take care of your current financials, and create a budget for the future.

You also get personalized reports that help you make informed business decisions.

Lastly, the bookkeeper you get from QuickBooks helps you categorize transactions so that you’re all set for the tax season.

Note: QuickBooks bookkeepers work remotely and connect with you via video call.

How to Decide Who to Hire

So you have a list of potential bookkeepers who can be an excellent fit for your business. Great! But how will you decide who’s the one who will be a perfect fit?

Follow these simple steps:

Step 1: Prepare a List of Questions to Ask During the Interview

Assuming you’ve shortlisted candidates after looking at multiple options to hire a bookkeeper, ask a potential candidate the following questions to assess who can do a better job for your business.

- What’s your experience in bookkeeping so far?

- How do you stay on top of changes in accounting regulations and standards?

- What’s an example of a time when you had to deal with a difficult situation, like a discrepancy in financial records or a client issue?

- How do you keep everything organized and ensure all bookkeeping tasks are done on time?

- What specific bookkeeping software or systems have you used before? How confident are you in using them?

- How do you keep sensitive financial information, like payroll records and tax information, secure?

Add any other questions that are important to you, and keep notes of the candidate’s answers during your interviews.

Step 2: Evaluate Candidates’ Qualifications and Experience

If you already have the resumes of candidates in hand, start by looking at their qualifications.

Preferably, the candidate has a degree or certification in accounting or bookkeeping and can demonstrate a strong foundation in accounting principles and bookkeeping practices.

As far as experience is concerned, try to pick a candidate who has experience in your field of business. For example, if you’re a restaurant owner, look for a bookkeeper who has worked with a restaurant earlier. If you have a service-based business, look for someone who has done bookkeeping for other service providers.

Step 3: Check References and Conduct Background Checks

For checking references, you can contact the references provided by the candidate to verify their work history, skills, and personal qualities. You can ask questions about their job responsibilities, performance, strengths and weaknesses, and other aspects of their work.

Conducting background checks involves verifying the information provided by the candidate, including their employment history, criminal record, and education.

Next Steps

No matter your business’s industry, you need a bookkeeper to maintain and optimize business finances. If you’re financially savvy, you may be able to keep your books yourself. But even if you have a degree in accounting, as a business owner, your time is probably best spent elsewhere in your business on things like strategy.

Remember this: Don’t look at hiring a bookkeeper as another business expense. Instead, look at it as an investment. A bookkeeper will help you cut costs, optimize expenditures, and help you make the best decisions for growing your business by bringing your finances on track.

Free Checklist Download

Download the 4-Page Checklist for Hiring a Bookkeeper for free. Print out the four pages and get started today.

No opt-in required! Just click the button below and download directly.